Excel Formula Help - ACCRINT for periodic interest payments from a security

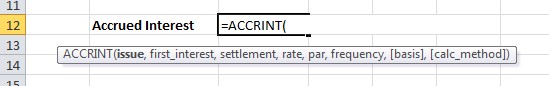

Microsoft Excel provides the ACCRINT formula to calcultate accrued interest paid on a security. The formula takes into account a number of variables, following the formula prompt as shown here:

Let's run through the list so that we are clear on the meaning of each:

- issue : This is the date that the security was first issued (not the date it was purchased).

- first_interest : The date that investors first receive interest payments on the security

- settlement_data : the date that the security is purchased by investors

- rate : the annual interest rate

- par : the face value or listed value of the security

- frequency : the number here relates to the frequency of payments 1 - Annual, 2 - Bi-Annual, 4 - Quarterly

- [basis] : relates to the number of days in a month and year. This variable, an number between 0 and 4, denotes the jurisdiction and accounting rules. For example, 0 refers to US (NASD) 30/360 (30 days per month, 360 days per year).

- [calc_method] : either TRUE or FALSE. If TRUE, interest is calculated from the issue date to the settlement date; If FALSE, interest is calculated from the settlement date to the first interest date.

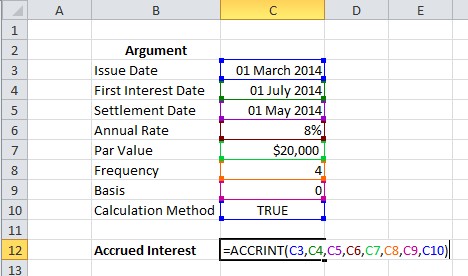

The formula follows: =ACCRINT(C3,C4,C5,C6,C7,C8,C9,C10)

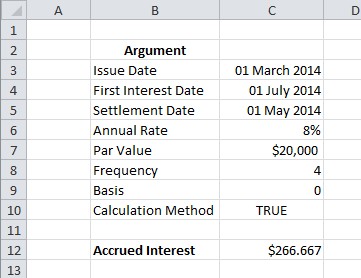

The Accrued Interest for the period calculated in given.

For more help with financial formulas, contact the Excel4Business experts. Help is also available from Microsoft here.